What is a Partial Payment?

Partial Payments are for when you want to apply a partial payment to a transaction. A classic example of a Partial Payment is when a Tenant only pays a portion of their rent, say $200 of a $1000 rent. In this case the $200 is considered a Partial Payment. You can apply as many Partial Payments to a transaction as you want.

Apply a Partial Payment

Partial Payments can be applied in both the main Accounting Entries and Suggested Accounting Entries sections of the software. The process is almost identical in both but for the purposes of this section we will mainly focus on the main Accounting Entries table.

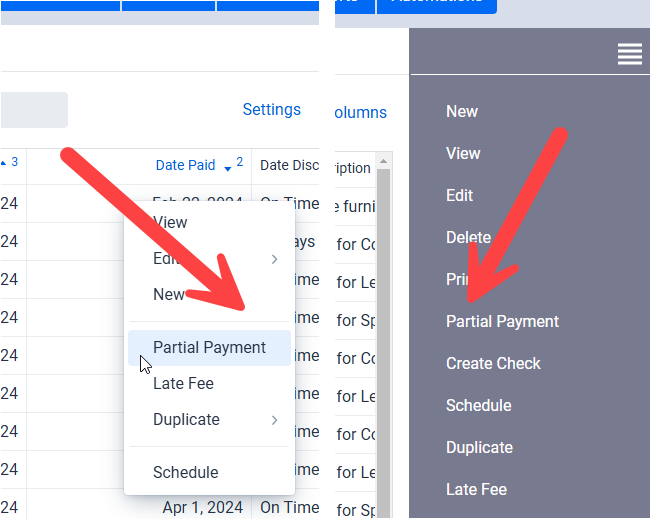

To apply a Partial Payment select the Accounting Entry and then either click on the Partial Payment in the right menu as shown in the above screenshot on the right side. Alternatively you can right click on the entry and use the Partial Payment option in the popup menu as shown on the left side of the screenshot.

** IMPORTANT: You can only apply a Partial Payment to an Accounting Entry that is not yet paid. That is to say an Accounting Entry where the Date Paid and Amount Paid are empty. This does not apply to Suggested Accounting Entries.

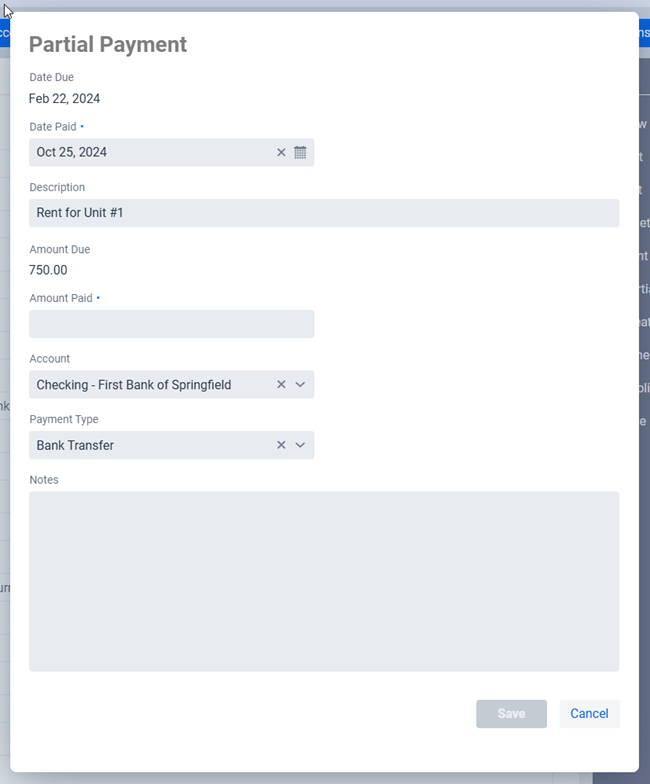

Since this is a Partial Payment the software only shows you the fields that should be applicable to the Partial Payment in a popup dialog rather than going to the form view. So for example the Tenant field is not displayed because it should be the same for the Partial Payment. If you need to edit the Tenant or other such fields then it’s really not a Partial Payment any more and you would be better off editing the Accounting Entry, or creating a new one, rather than applying a Partial Payment.

** NOTE: You don’t need to worry about editing the Amount Due as the software will automatically make all the appropriate calculations and adjust the Amount Due value when you click on the Save button. It’s more to let you know what the total amount due is.

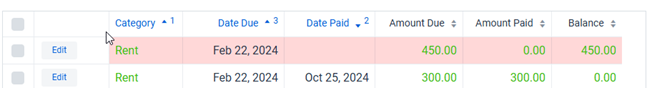

After you click on the Save button you will find that the Accounting Entry has been split into two Accounting Entries. One for the Partial Payment made and for the remainder of due. In

Using the example above in the screenshots the initial rent due was for $750. The tenant paid $300 and so $450 still remains outstanding. If you look at the columns the Amount Due column totals up to $750, the Amount Paid column totals up to $300 paid, and the Balance column totals up to $450, exactly what is remaining due and outstanding.

When it comes to Suggested Accounting Entries it’s a little different in that instead of two Accounting Entries the software will instead edit the existing Suggested Accounting Entry and create a new Accounting Entry. In other words if you applied the $300 payment to a Suggested Accounting Entry you would then have the same Accounting Entry for the $300 and the remaining outstanding $450 would remain in the Suggested Accounting Entry. For more details on this we’ll refer you to the section on Partial Payments in the Scheduled Accounting Entries section of the user manual.

** TIP: You can apply as many Partial Payments as you like, there are no limits. So for example if a Tenant has a rent due for $1000 they can pay in $100 installments and you can just click on the Partial Payment button each time to apply the $100 partial rent payment.