Introduction

Firstly Invoices and Receipts should be viewed as documents rather than accounting data. For example you could create an Invoice (and Receipt) for a rent check that then bounces. In this case you still need to keep the record of both the Invoice and Receipt to as paperwork to possibly evict the Tenant in court but at the same time you need your accounting data to reflect no payment was made. As a result you should not be editing the Invoice and Receipt after they have been provided to the Tenant which is why they are viewed as documents rather than accounting data. Only accounting data should be edited after the fact. In fact that same Tenant could pay you again with another bounced check at which point you have another set of Invoices and Receipts before they finally pay you. In other words you could have 1, 2, 3, or more Invoices and Receipts for the same rent and if that’s the case you don’t want the system to create multiple rent payment entries in the accounting data because you have multiple Invoices and Receipts for the same rent. As a result the software does NOT use the Invoice and Receipt data as accounting data, nor is it used for the accounting reports. The Receipts and Invoices should instead be viewed as documents.

** NOTE: Invoices and Receipts are completely optional, you can choose to use them or not, it’s completely up to you. Some people use them for every single Tenant and every single transactions, some use them only when requested, and some people don’t use them at all. Again it’s completely up to you and depends on your operations and business model.

Invoices are meant to be given to your tenants (either digitally or in printed form) before the rents are due, almost as a notice of payment due. One of the benefits of this is that you have evidence in court that your tenants knew ahead of time when and what rents were due. Invoices are not just use for rents, you can produce an invoice to your tenant to inform them about any amount they may owe you (electricity bill, parking…).

Receipts are a record of payment which you give to your tenants after you have received the rent or other payments. Again it is possible that a payment fails in which case the Receipt should still nonetheless be kept as it is a record that should match up with what was provided to the Tenant.

** IMPORTANT: Again please note there is no link within the software between the invoice/receipt payment and the above mentioned reasons (as well as additional reasons), and that they should be viewed as documents. For example if you edit an Accounting Entry, the software shouldn’t change the Invoice because this may have already been printed and given to your tenant. Similarly, it’s possible that the tenant doesn’t pay, doesn’t pay in full, and so on, which means that the Invoice may not match the actual Accounting Entry. Therefore, changing an Accounting Entries value in the accounting screen will not change the invoice payment entry, or vice versa.

All the steps required to deal with a Receipt are the same as for Invoices, and vice versa. Therefore, we will describe only the steps related to an Invoice because they are the same for Receipts.

Create an Invoice/Receipt

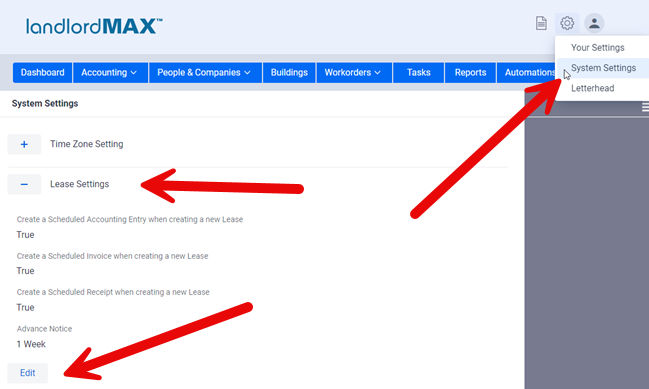

Each time you create a new lease, by default the software will create for you a new Scheduled Invoice and a Scheduled Receipt so that they are both automatically created for you and are recurring at the frequency you specified in the lease (for example every month).

This feature can be enable or disabled in the System Settings menu, when you click Lease Settings and then select the preference group to Edit button.

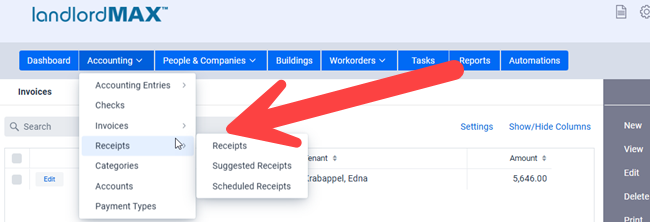

Create a one-time invoice or receipt

To create a new one time Invoice, go to Invoices menu, click New on the top right of the screen and fill the information related to that invoice. The Start and End Dates of the Invoice are to indicate the timeframe which the invoice is applicable. So for example a rental invoice for the month of January would be from January 1st to January 31st. However if you prefer you can also have the Start Date be the same as the End Date, again the software is very open and can be adjusted to your needs. We generally recommend using the date range of the rent (such as Jan 1st to Jan 31st) but again it’s completely up to you.

You can associate a landlord and/or a tenant to the invoice depending on which information you wish to present on the invoice.

** NOTE: If a Management Company is setup in the System Settings then the printed Invoice/Receipt will show the Property Management company rather than the Landlord on all printouts.

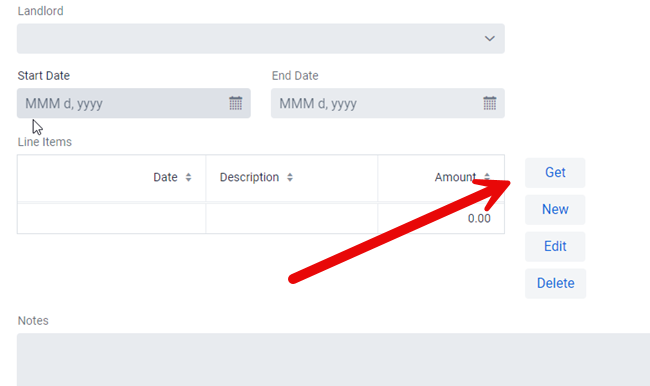

To add a payment from a pre-existing Accounting Entry Click Get on the right side of the items box otherwise click on New to create a new entry.

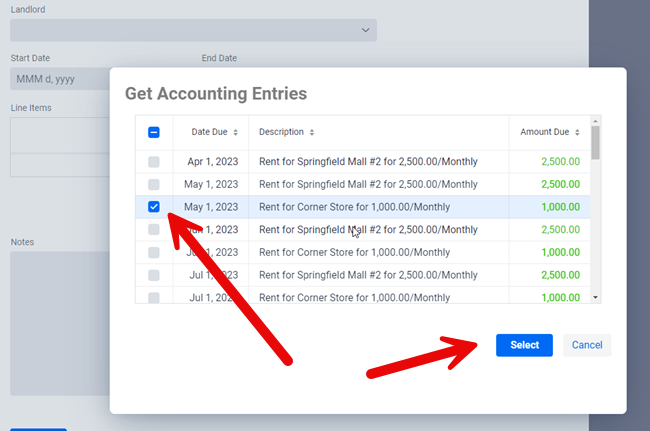

If you selected the Get option then a pop up window will display the list of accounting entries associated to the Landlord and Tenant you selected in the Invoice/Receipt. Choose the entries you want and click Select as shown in the above screenshot.

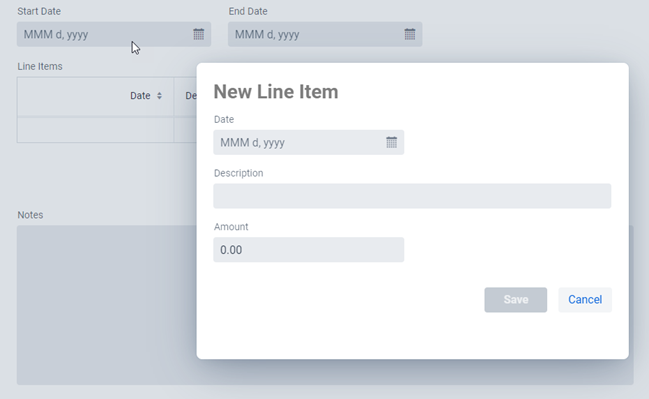

If you clicked on the New option, that is you want to create a new Payment, then you will see the above popup dialog where you can enter in the appropriate information and click Save.

Create a Scheduled Invoice/Receipt

Creating Scheduled Invoices and receipts is very much the same process as Scheduled Accounting Entries therefore we will refer you to that section for more details which you can go to by clicking here.

** TIP: In cases where the amounts may be different every month you can just leave the line items empty and fill them in as needed in the generated Suggested Invoices/Receipts the same as is described in the Accounting Entries section.

Print an Invoice/Receipt

In the upper portion of the screen select the invoice of your choice and click Print in the top menu. Please note that you can select multiple invoices for them to be print at the same time.

Email an Invoice/Receipt

Similarly in the upper portion of the screen View the invoice of your choice and then click Email in the top menu.

** IMPORTANT: You can only email one Invoice at a time because of two reasons. Firstly, and the main reason, sending all your invoices at the same time can result in your email address, domain, and so on from being incorrectly flagged as sending spam emails which can lead to all sorts of complications and problems. Secondly each invoice requires an addressee (To) and a message and not all Tenants may have emails setup for them.

Matching up Invoices/Receipts and Accounting

Invoices and receipts are separate and independent and they may not match up to the accounting system due to the above mentioned reasons. For example a check bounces but you need to keep the invoice/receipt that was provided to the tenant, or maybe the rent is never paid but the invoice is sent, and maybe even a receipt was printed for a bounced check. In this case, your invoices may not always match your receipt, nor the accounting entries. Therefore because they are separate you can do whatever type of mixing and matching you need, which works to your advantage here.

As well, many tenants don’t really care or want any invoices and/or receipts even if they should, so for those property managers and landlords it’s possible to omit this section completely for those tenants and save them some time when processing rents. In other words by doing this you’re not forced to have to create Invoices and Receipts for all your Tenants, especially those that don’t want it, which does require a bit of extra effort, no matter how streamlined the process is.

This is also why all accounting related reports generate their data only from the accounting section and not the Invoices and Receipts.