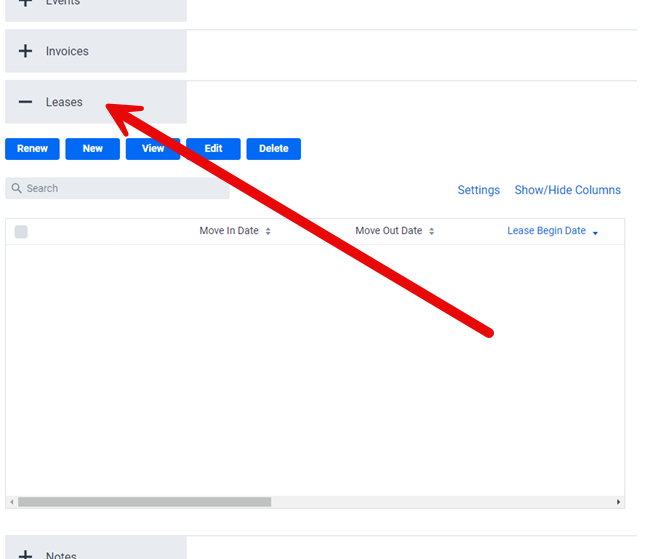

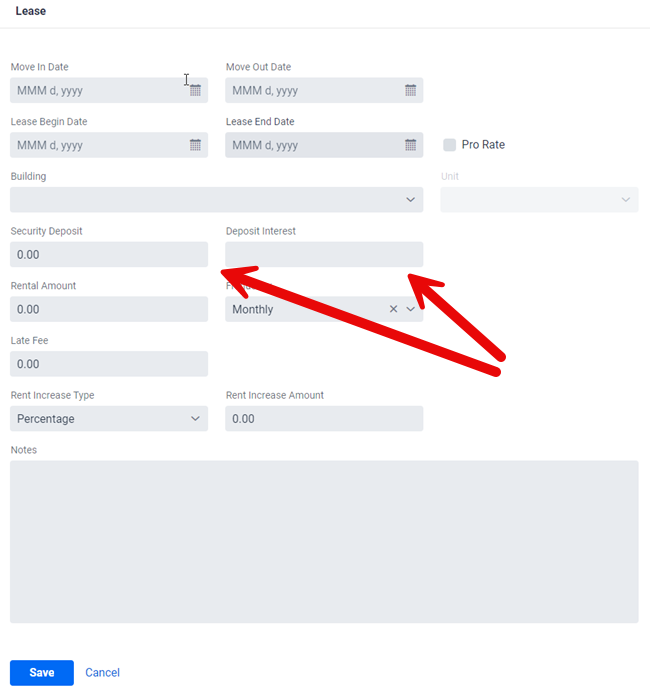

Security deposits are recorded with the leases information. Go into the Tenants entry, click the Leases subsection, then either click New if it’s a new Lease or edit if it’s an existing list to get to the Lease screen shown below where you can enter in the Security Deposit details.

To get a list of your security deposits, use the security deposit related reports.

When cashing out the security deposit (interest paid, money’s owed, etc.) there are two options which are listed below:

** IMPORTANT: For accounting purposes Security Deposits are a special case to which we offer you two options to handle them (the first option being the recommended option). It is also very strongly recommend you consult with your accountant as to which method you prefer, as the selected option will determine how and where the amounts are displayed in the reports.

1. The first and easiest is just to record the security deposits with the leases and use the security deposit related reports. This keeps the information simple. In this regard you’d only enter in a Accounting Entry for the difference when cashing out the security deposit (interest paid, money’s owed, etc.) because the rest is just considered a deposit and not an income (portion kept for repairs, etc.) or expense (interest paid on deposit, etc.). As well by going this route it separates out your “real” revenues from your deposits.

2. The alternative option, depending on how you look at your business model, is to also add the amount as a new accounting entry associated to a new custom accounting category (which you can create) called “Security Deposit”. However this means the security deposits would appear as revenue in your reports (including cashflow) and can have tax implications depending how you run your reports.